Futurum Signal is Live: Real-Time Market Intelligence for the Cloud-Native Era

The cloud-native world doesn’t stand still. Kubernetes releases every quarter, new distributions popping up like mushrooms, service meshes evolving faster than you can deploy them, and now agentic AI reshaping how we build and run applications. In that kind of environment, a static analyst report—produced once a year and outdated before it’s even published—simply doesn’t cut it.

That’s why today’s announcement matters: Futurum Signal is live.

Futurum Signal is a real-time, AI-powered market intelligence platform designed for the speed and complexity of the cloud-native era. It cuts through vendor hype and provides continuously refreshed insights on who’s delivering value, who’s innovating, and who’s struggling to keep up. For developers, SREs, and platform teams trying to make sense of an ever-shifting ecosystem, it’s a new kind of compass.

Why Cloud-Native Needs Signal

Cloud-native isn’t just about adopting Kubernetes or containers. It’s about embracing an ecosystem that moves at breakneck speed—where observability, security, CI/CD, service meshes, data platforms, and now AI workloads all converge.

But here’s the problem: too many tools, too many vendors, too much noise. The old ways of sorting the landscape don’t work. Analyst quadrants can’t keep pace with GitHub commits, CNCF project launches, or AI-driven pivots that happen in real time.

Futurum Signal changes that by combining:

- Millions of practitioner reviews from G2–real feedback from real users.

- Agentic AI harvesting and verifying public data–from vendor websites to research reports to open web signals.

- Futurum analyst expertise–layering human validation and context over the data.

It’s a three-legged stool that produces a market view you can actually trust—not just once a year, but continuously.

Inside Futurum Signal

What makes Futurum Signal compelling is not just the data, but how it presents it.

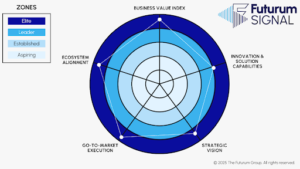

The Radar View maps vendors against five dimensions that matter in the cloud-native world: Business Value Index, Innovation & Solution Capabilities, Strategic Vision, Go-to-Market Execution, and Ecosystem Alignment. Instead of a static chart, you see vendors grouped into zones—Aspiring, Established, Leader, Elite—with strengths and weaknesses visible at a glance.

The Vendor Comparison Bubble shows relative maturity in concentric rings, helping teams quickly identify which vendors are breaking out and which are still climbing.

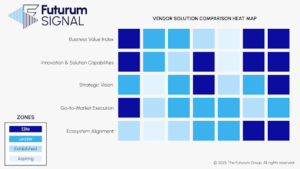

The Heat Map View lays vendors side by side across all five categories, showing patterns of consistency and gaps. For a team debating between observability platforms or deciding which security vendor to back for Kubernetes workloads, this kind of comparative fingerprinting is invaluable.

And beyond the visuals, Futurum Signal offers dashboards and deep dives where you can drill into a solution area, a vendor, or a trend—continuously updated as the market moves.

Today’s Launch: Data Intelligence Platforms

Futurum Signal launches today with its first solution area: Data Intelligence Platforms. In cloud-native environments, data is everywhere: telemetry fueling observability, logs driving security insights, and AI workloads demanding real-time pipelines. For developers and SREs, knowing which platforms handle data best isn’t just a strategic choice—it’s existential.

More solution areas are coming soon: Security Operations Platforms, Software Engineering Platforms, Agentic AI Platforms, AI Cloud Platforms, Sales/Service/Marketing Platforms, and Cloud Marketplace Platforms. The roadmap may evolve, but the intent is clear—to cover the full spectrum of cloud-native and adjacent markets where platforms and tools are converging.

The Questions Everyone Asks

Since announcing Futurum Signal last week, I’ve been fielding questions from vendors and practitioners alike. Three in particular come up again and again:

Q1: How do you collect the data?

Through our three-legged stool: (1) millions of reviews from G2, (2) agentic AI continuously harvesting and validating public data, and (3) Futurum analysts adding context and insight.

Q2: How do you access it?

Subscribers get continuous access to their chosen solution areas. Vendors will license Futurum Signal data for their own use. And for the broader community, Futurum will publish executive summaries and snapshots.

Q3: Can vendors influence the findings?

No. This isn’t the old analyst game where a steak dinner or a sponsorship buys you a better chart position. Futurum Signal is immune to that. The data is the data—practitioners and the open web don’t lie.

Why This Matters for Cloud-Native Teams

Cloud-native adoption has always been about speed and scale. But speed without clarity is just chaos. Futurum Signal brings clarity, not by replacing human judgment, but by grounding it in real data, refreshed in real time.

For platform teams, it helps decide which tools belong in the stack. For developers, it highlights which vendors are actually delivering value. For vendors, it’s a wake-up call: marketing spin won’t get you to the Elite zone. Only execution will.

Futurum Signal isn’t static. It will evolve as AI evolves, as CNCF projects rise and fall, and as markets shift. But that’s the point. Like cloud-native itself, it’s a living system.

At some point, you stop iterating and ship. For Futurum Signal, that moment is today. And for the cloud-native community, it couldn’t be better timed.